Women’s labor force participation has grown significantly in the last 70 years; while men still outnumber women in the workforce, the gap has narrowed considerably. More women than ever are pursuing higher education, and in fact, women have earned the majority of college degrees for the past few decades. Despite this progress, however, a sizable gender pay gap between men and women remains. The latest data from the U.S. Census Bureau shows that women earn, on average, just 81 cents for every dollar earned by a man. That is, the ratio of annual earnings for full-time working women to full-time working men is 81 percent—a pay gap of 19 percent.

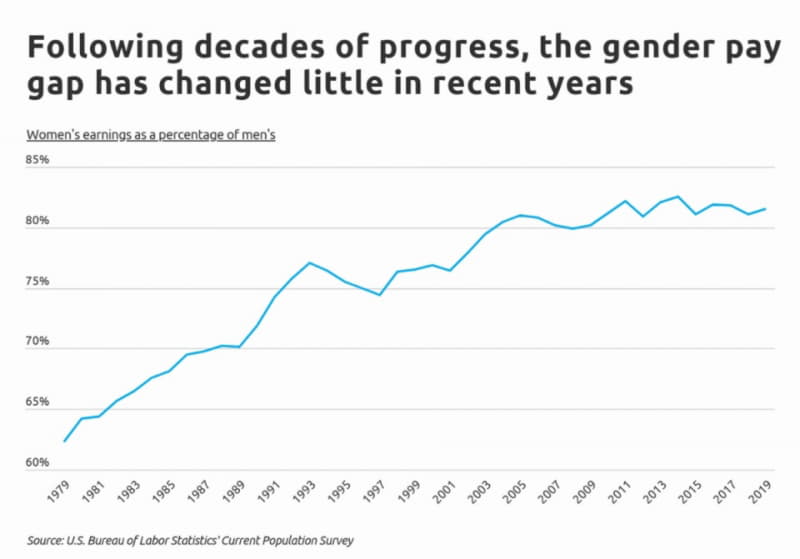

The gender pay gap has been shrinking steadily until recent years. In 1979, full-time women earned just 62 percent of what full-time men earned, but over the next 30 years that number had risen to 80 percent. After decades of improvement, however, the ratio of women’s earnings to men’s earnings has remained relatively stable, hovering just above 80 percent. While some of the remaining gap can be explained by factors such as occupational segregation and work experience, other factors that are difficult to quantify and measure, including discrimination, also play a role.

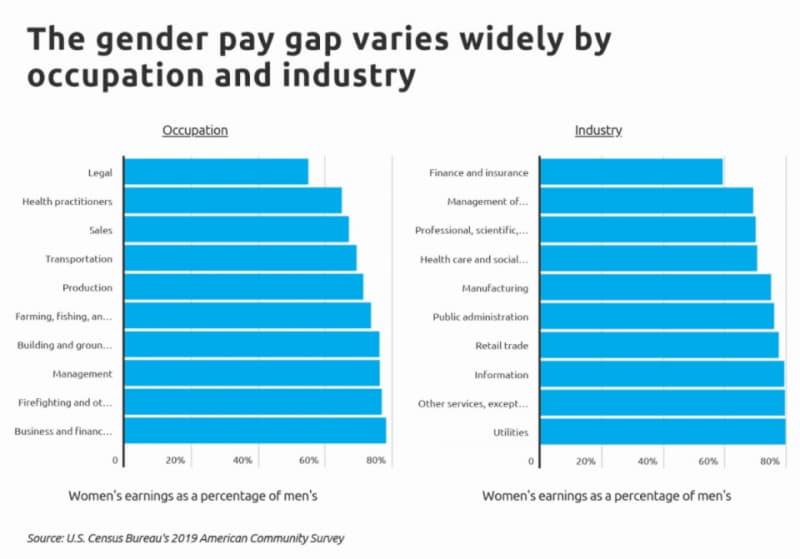

While the ratio of women’s earnings to men’s is about 81 percent, on average, this ratio varies considerably across occupations and industries. Legal occupations have the largest gender pay gap, with women in legal occupations earning just 55 percent of what men in legal occupations earn. However, much of this pay discrepancy can be explained by the disproportionate share of women working in lower-paying legal jobs—for instance, paralegals or legal assistants. Men, on the other hand, are much more likely than women to be lawyers. Health practitioners have the second largest gender pay gap, with women earning about 65 percent of what men in the field earn.

At the industry level, the finance and insurance industry has the largest gender pay gap, with women in this industry earning 59 cents on the dollar. Occupational sorting by gender, or the job choices than men and women make, in the finance and insurance industry likely explains a significant portion of the pay gap in this industry. Women are more likely to work as lower-paid bank tellers while men more frequently work as financial advisors. The reasons behind occupational segregation by gender are complicated, but experts cite gender differences in preferences, social norms, and discrimination as key drivers.

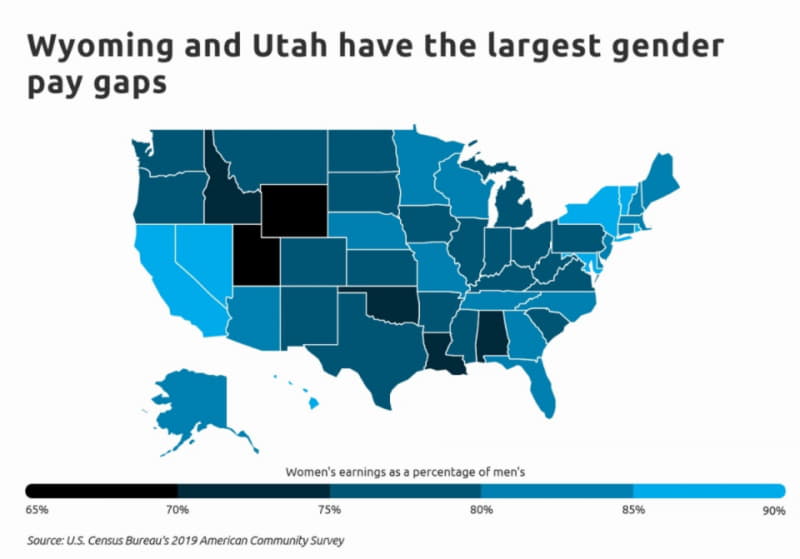

The gender pay gap varies widely on a geographic basis as well. In some cities and states, women tend to earn much less than men, while in others, women’s pay is more equitable. At the state level, Wyoming and Utah have the most significant gender pay gaps, with women earning just 63 percent and 70 percent of men’s earnings, respectively. Female workers in Maryland and Vermont are compensated more equitably compared to their male counterparts. In these states, women earn 88 percent and 91 percent of men’s earnings, respectively.

To find the metropolitan areas with the biggest gender pay gaps, researchers at Self Financial analyzed the latest data on earnings from the U.S. Census Bureau. The researchers ranked metros according to the ratio of full-time working women’s earnings to full-time working men’s earnings. Researchers also calculated median annual earnings for full-time women, median annual earnings for full-time men, the industry with the largest wage gap, and the occupation with the largest wage gap.

To improve relevance, only metropolitan areas with at least 100,000 people were included in the analysis. Additionally, metro areas were grouped into cohorts based on population size. In the report, small metros have between 100,000 and 349,999 residents; midsize metros have between 350,000 and 999,999 residents; and large metros have 1,000,000 or more residents.

The analysis found that in the Baltimore metro area, women earn 85.3% of what men earn, on average. Out of all large metropolitan areas, Baltimore has the 15th smallest gender pay gap. Here is a summary of the data for the Baltimore-Columbia-Towson, MD metro area:

- Women’s earnings as a percentage of men’s: 85.3%

- Median annual earnings for full-time women: $56,693

- Median annual earnings for full-time men: $66,471

- Industry with the largest wage gap: Finance and insurance

- Occupation with the largest wage gap: Construction and extraction occupations

For reference, here are the statistics for the entire United States:

- Women’s earnings as a percentage of men’s: 81.0%

- Median annual earnings for full-time women: $43,394

- Median annual earnings for full-time men: $53,544

- Industry with the largest wage gap: Finance and insurance

- Occupation with the largest wage gap: Legal occupations

For more information, a detailed methodology, and complete results, you can find the original report on Self Financial’s website: https://www.self.inc/blog/cities-with-biggest-gender-pay-gap