Summary

- While the coronavirus crisis isn't yet over, the REIT sector appears likely to avoid the type of long-term lingering pain that was felt by the sector during the Financial Crisis.

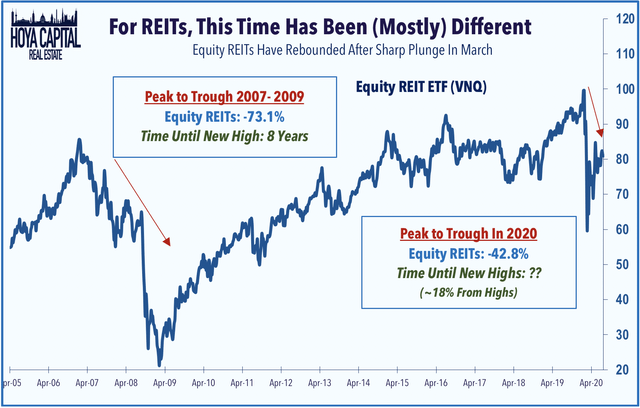

- REITs plunged 70% during the Great Financial Crisis and took nearly eight years to return to prior highs. Back in March, pundits were forecasting a similar "lost decade" for REITs.

- Most REITs had been "preparing for winter" for the last decade. Some aspects of this crisis were more acute than the GFC, but strong balance sheets and access to capital prevented disaster.

- As anticipated, REITs reported significant declines in FFO, dividends, and NOI in the second quarter as REITs struggled to collect rent from "non-essential" tenants, metrics that should rebound in Q3.

Second-quarter fundamental metrics underscore the central theme that we've discussed extensively throughout the coronavirus pandemic: it all comes down to rent collection, which has improved sequentially every month since April.

This idea was discussed in more depth with members of my private investing community, iREIT on Alpha. Get started today »

State of the REIT Sector

In our quarterly State of the REIT Sector, we analyze the recently-released NAREIT T-Tracker data to review REIT fundamentals over the past quarter. We review our commentary published at the outset of the pandemic in early March, REITs: This Time Is Different when we concluded: "It may be hard to believe now, but things will get better. We believe that the residential and commercial real estate sectors are prepared to weather the storm, but pockets of stress will undoubtedly emerge if the COVID-19 outbreak intensifies, but highly-levered retail and lodging REITs could be in a fight for survival."

REIT Fundamental Metrics Slammed Amid Pandemic

While the coronavirus crisis isn't yet over, the REIT sector appears likely to avoid the type of long-term, lingering pain that was felt by the sector during the Financial Crisis. The Vanguard Real Estate ETF (VNQ) plunged nearly 75% from its peak in 2007 to its trough in 2009 and didn't recover to its previous pre-recession highs until nearly eight years later in 2015. While REITs have been slower to rebound than the S&P 500 ETF (SPY), the sector has recovered half of its losses over the last five months, a feat that took nearly two years during the Great Financial Crisis, suggesting that while some aspects of this crisis were more acute than the GFC, strong balance sheet management and ample access to capital prevented the type of shareholder dilution that plagued the REIT sector in the early post-recession period.

As anticipated, however, REITs reported significant declines in FFO ("Funds From Operations"), dividends, and NOI ("Net Operating Income") growth in the second quarter as REITs struggled to collect rent from "non-essential" tenants. FFO per share dipped -31.3% from last year, which was the fourth-worst quarterly decline on record, topped only by 4Q08, 1Q09, and 3Q09 amid the depths of the Financial Crisis. Dividends per share, meanwhile, declined by -9.9% on a year-over-year basis as 62 of the 170 equity REITs eliminated or reduced their distribution from March through July while roughly 20 REITs raised payouts. Same-store NOI growth - reported by NAREIT on a trailing-twelve-month basis - recorded record declines of -7.5% in Q2, far exceeding the -2.1% maximum decline during the Financial Crisis.