- Omega Healthcare Investors is heavily involved in the skilled nursing segment.

- After years of regulatory issues, the segment is now looking at some changes.

- Omega Healthcare Investors posted better than expected quarterly results.

- Looking for more stock ideas like this one? Get them exclusively at The Total Pharma Tracker. Get started today »

Omega Healthcare Investors (OHI) is amongst the largest healthcare REITs focused on the skilled nursing segment. While this once-lucrative segment is now dealing with a whole lot of issues, including regulatory ones, Omega Healthcare Investors stock offered over 30 percent return in the past 12 months. Not to mention the fact that, even with its current valuation, the REIT stock provides a robust dividend yield of nearly 7 percent. Here’s a look at the investment potential of the stock.

The Portfolio and the Outlook

Omega Healthcare Investors stands apart from regular REITs as this one is heavily invested in senior focused skilled nursing segment. While other REITs are gradually paring their exposure to this troubled sector, Omega Healthcare Investors is going ahead with strengthening its foothold here. In the third quarter of 2019, the REIT signed an agreement to acquire skilled nursing and assisted living facilities worth $735 million. This bold step of acquiring skilled nursing facilities while other REITs are abandoning them is likely to play in favor of Omega Healthcare Investors as the sector is expected to come out of the slump following some recent developments in the regulatory environment governing it.

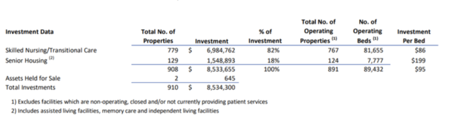

Source: Company Website

As on the end of the March quarter, the REIT had 779 skilled nursing facilities and 129 senior housing properties in its portfolio, making it an almost pure play REIT in the highly skilled nursing segment. It is almost fully invested in the US with minuscule interest in facilities abroad and therefore is more exposed to the regulatory environment prevailing domestically. This low diversification precludes the possibility of compensating for domestic risk, but it allows the REIT to specialize in its target market. This focus on US markets has let Omega Healthcare Investors become a leader in its segment.

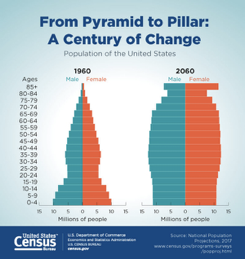

Apart from skilled nursing, the REIT has interest in the senior housing segment as well, roughly accounting for one-fifth of its portfolio. Senior housing, in contrast to skilled nursing, is poised for fast track growth. Owing to explosive increase in senior population, the demand in this sector is expected to amplify exponentially.

Source: Census.gov

Overall, the outlook for senior living sector is rosy in general. However, it is also worth noticing that, due to its high potential, the sector has become a hotbed and has attracted a number of new entrants, including high-profile REITs. Moving ahead, the sector may show signs of saturation as supply side for the market swells up faster than the demand side. As Omega Healthcare Investors is a relatively small player in the segment, it needs to remain wary of the macro environment and devise its strategies accordingly.

Coming back to Omega Healthcare Investors’ specialty sector of skilled nursing, things may look bleak at the outset. However, it is important to pay attention to potential changes in the sector. Skilled nursing segment was deeply affected by the provisions of Affordable Care Act. One of the most prominent developments is the upcoming implementation of Patient Driven Payment Model (PDPM), effective from October 1, 2019. The new model is expected to improve the reimbursement system and is expected to have positive impact on REIT players in skilled nursing segment. The new plan essentially brings about changes in Skilled Nursing Facility Prospective Payment System for the classification of SNF patients under covered Part A stay.