2U Inc. (NASDAQ:TWOU) announced third-quarter 2017 results on Tuesday after the market closed, detailing continued strong revenue growth, a narrower-than-expected net loss, and the expansion of its scope with the close of a key acquisition. 2U also accelerated its domestic program launch (DGP) schedule, offered encouraging preliminary guidance for the coming year, and unveiled plans for its first international program launch in 2019.

Let's pull out our notebooks, then, to better understand what drove 2U's business over the past few months, and what investors can expect from the fast-growing online education platform specialist going forward.

IMAGE SOURCE: GETTY IMAGES.

2U results: The raw numbers

| Metric | Q3 2017 | Q3 2016 | Year-Over-Year Growth |

|---|---|---|---|

| Revenue | $70.3 million | $52 million | 35.2% |

| GAAP net income (loss) | ($14.7 million) | ($6.8 million) | N/A |

| GAAP earnings (loss) per share | ($0.30) | ($0.14) | N/A |

DATA SOURCE: 2U INC.

What happened with 2U this quarter?

- Of 2U's 35% top-line growth, 27% was attributable to growth in the company's graduate program business. The remainder was driven by contributions from 2U's $103 million acquisition of online short-course specialist GetSmarter, which closed on July 1, 2017.

- On an adjusted (non-GAAP) basis, which offers perspective by excluding acquisition expenses and stock-based compensation, 2U's net loss was $7.4 million, or $0.15 per share, compared to a net loss of $2.7 million, or $0.06 per share in the same year-ago period.

- 2U incurred an adjusted EBITDA loss of $3.7 million, compared to an adjusted EBITDA loss of $0.2 million in last year's third quarter.

- By comparison, three months ago 2U told investors to expect lower revenue in the range of $68.8 million to $69.8 million, a wider GAAP net loss per share of $0.34 to $0.33, and a wider adjusted per-share loss of $0.21 to $0.20.

- 2U has now slotted all 13 of its targeted domestic graduate program launches for 2018 -- a goal it increased last year from an initial target of 12. Most recently added to that list is the Yale Physician Assistant program, classes for which will begin in January 2018.

- Due to university demand, 2U is increasing its 2018 DGP launch goal to 14, and is now targeting 16 DGPs for launch in 2019.

- 2U also plans to launch its first international graduate program in 2019.

What management had to say

2U co-founder and CEO Chip Paucek stated:

We have now delivered 15 quarters of strong financial results with no plans of slowing down in 2018. We are further cementing our leadership position and forging new pathways in the digital education space with short courses. Although we expect the domestic graduate landscape to continue to produce strong growth, short courses now allow us to provide a more comprehensive product solution to our clients. Based on this combined strength, we expect 2018 year-over-year revenue growth of between 38 to 39 percent. In addition, our acquisition of GetSmarter enables us to expand and more effectively serve the growing demand coming from global markets, a trend that we expect to continue in 2019 with our plans to launch 2U's first international graduate program, or IGP.

Looking forward

2U expects fourth-quarter 2017 revenue in the range of $84.6 million to $85.6 million, which should translate to GAAP net income of negative $0.6 million to positive $0.1 million, roughly equating to negative $0.01 per share to $0.00 per share. On an adjusted basis, 2U should generate net income of $7.3 million to $8.0 million, or $0.13 to $0.14 on a per-share basis.

As such, for full-year 2017, 2U now expects revenue in the range of $284.7 million to $285.7 million, marking a $2 million increase to the bottom end of its previous guidance range. That should translate to a full-year net loss of $0.62 per share to $0.61 per share (compared with a previous expected per-share loss of $0.67 to $0.65), and an adjusted net loss per share of $0.10 to $0.09 (compared with previous guidance for a loss of $0.19 to $0.17 per share).

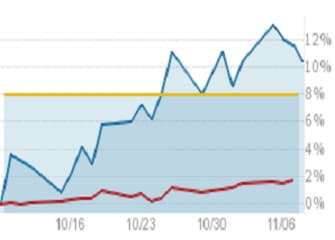

Bottom line: 2U just exceeded expectations on every metric, increased its 2018 DGP launch goal for the second time to meet demand, and plans to accelerate DGP launches yet again in 2019 while simultaneously marking the start of its international expansion. So apart from the fact that 2U stock has already more than doubled so far this year -- an enviable "problem" that may tempt skittish investors to take profits -- I can find nothing not to like about this stellar report.

Newly updated! 10 stocks we like better than 2UWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

On November 3, David and Tom revealed what they believe are the ten best stocks for investors to buy right now… and 2U wasn't one of them! That's right -- they think these 10 stocks are even better buys.