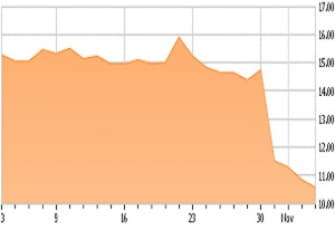

After UnderArmour recently reported dismal 3rd quarter 2017 results, I have lost hope for a turnaround. The company has lost their strategy of being an innovative upscale brand in an unsuccessful effort to maintain sales growth through deep discounting. Given the fact that the stock is still expensive on a Price-to-Earnings (PE) ratio and no optimism on the horizon due to consumer sentiment and increased competition, I expect the stock to continue to decline.

In this article, I'll identify topics from the earnings report to support my opinion. In my September 25th, 2017 article on Under Armour (UA, UAA), I wrote:

READ FULL ARTICLE HERE