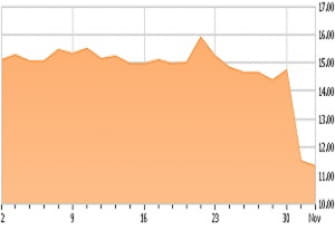

Under Armour (UAA) (UA) just reported terrible results on all fronts. It missed analysts' expectations and revised the guidance downward once again. The management sees the difficult environment to persists at least through the end of this year and 2018. The shares plummet by more than 20% following the earnings announcement and are down almost 60% this year. It is one of the most challenging years in Under Armour's history and this environment may persist for longer. At the moment, it is very hard to see the brighter future in the current environment and I can image this situation to persists for foreseeable future. Perhaps the company reached a point of saturation in the United States and will be a lower growth company in the future. But Under Armour has still an opportunity to replicate the success story worldwide. The company derives 75% of revenue from North America hence the global markets represent a tremendous opportunity to replicate the success story on a global scale. The Under Armour's history suggests it has the owner who can do it and who can turn the company around. Even though it may be hard to see that for current shareholders having seen such deterioration in business and decline in shares.

READ FULL ARTICLE HERE