Gary Williams, CFP, CRPC, AIF

2017 is a critical year for Europe. The outcomes of the many local and national elections in the member states of the European Union (EU) willdefine the future political and economic structure of Europe. But why is this union of 28 countries so important, and what are the implications for you should it disintegrate?

To start, let’s review some EU history, discuss its current state of affairs, and consider what the future may hold. Finally, we’ll explore how what happens abroad could affect your portfolios.

Creation of the euro:Prelude to the current state of instability?

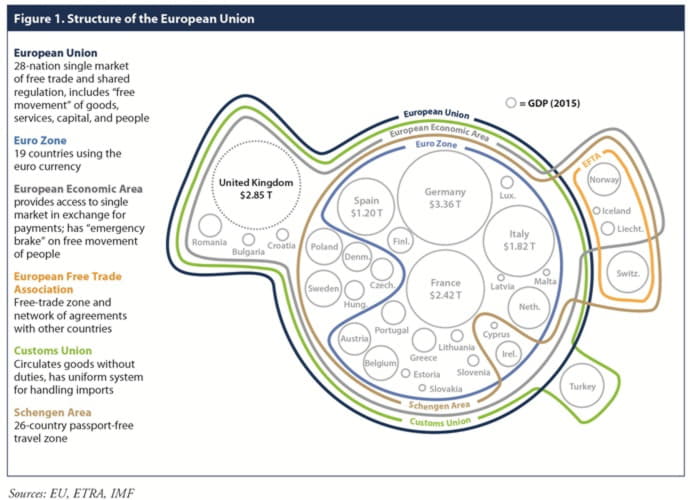

On January 1, 1999, 11EU member states adopted a single currency—the euro—as their medium for exchange. As of this writing, 19 European nations use the currency, making them part of a “eurozone.” The commitment to a single currency was expected to push toward a stronger monetary, fiscal, and, eventually,political marriage—a “United States of Europe,” if you will.

At the outset, the European Central Bank (ECB)—the watchdog of eurozone nations—needed to devise a unified monetary policy for memberswith divergent economic, social, and political circumstances. To do so, itset a compromise interest rate: betweenthe low rates appropriate for slow-growing economies (e.g., France, Germany, Austria)and the higher rates demanded by lenders to fast-growing countries on the EU periphery (e.g., Ireland, Greece, Spain). This compromise interest rate had two effects: It incentivized the periphery to borrow more in order to fund growth and deficits, but it also promoted capital flow from the financial institutions of core members to the periphery as they overextended in search of yield.

Althoughcapital flows from the core led to overheated markets on the periphery, investors were comforted by the fact that the monetary union had made each member “too connected to fail.” Acknowledging the potential for moral hazard, however, the governing eurozone bodies declared that there would be no bailouts. Despite this,however, bailout expectations remained strong.

It’s important to keep in mind that what happened in the eurozone was a reflection of other capital markets. Specifically, the U.S. and U.K. were flush with money, feeding bubbles in housing and asset markets. When the financial crisis hit, the pain was no less for those nations, but non-eurozone countries had more flexibility for dealing with the crisis. They could define their own monetary, fiscal, and exchange rate policies; this was aprivilege that eurozone members had lost by relinquishing their currencies in favor of the euro.

When the eurozone’s peripheral members began crumbling under massive debt, the ECBat first resisted but then handed bailout funds to some—Greece, Ireland, and Portugal—and bought the government bonds of others—Italy and Spain—to reducetheir costs of borrowing. In return, the prodigal members were required to implement severe austerity measures and budget controls to get back in line with EU monetary requirements.

Meanwhile, as the debt crisis brewed,“euroscepticism”rose—partof a wider criticism of the liberal economic order that had led to deep inequalities and chronic unemployment. Other forces at work included discontent and concerns aboutausterity measures, the surge in migrants and its consequences, and growing Russian power. These circumstances fostered disillusionment with Europe’s political and intellectual elite—manifesting in an increase inthe popularity of far-right nationalists and populists.

What does 2017 hold for Europe?

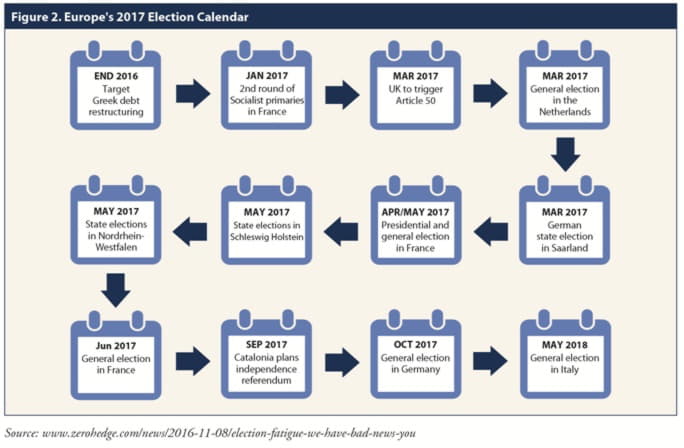

This year brings a busy election calendar for Europe (see Figure 2). Early on, it appeared that nontraditional populist parties were gaining traction, but sentiment seems to be changing. Let’s look closer at what some of these elections may mean for the EU.

First, if the populists are elected to policymaking positions, it’s likely we wouldsee EU dismemberment. Should Italy, Greece, or any other member officially leave the EU and redenominate its debt in its own currency, there would be massive capital flight from the peripheral countries, perhaps leading to capital controls. Bond spreads would widen. The effect on currencies would be more complicated.

Alternatively, another scenario could emerge. If recentFrench and Dutch election results are a bellwether,centrist or federalist candidates could do well in forthcoming contests. That being the case, the winners would have two options: either maintain the status quo bykicking the can down the road because populism couldn’t be written off yet, or embark on eurozone reforms in an attempt to address the social factors that fueled the populist rise.Leaders of the status quowould also need to deal with the issue of fiscal integration among members and eventually move toward greater political unity. This is an extremely difficult path but one that would have tobe taken for the eurozone to emerge from its constant state of instability.

Market opportunities and threats

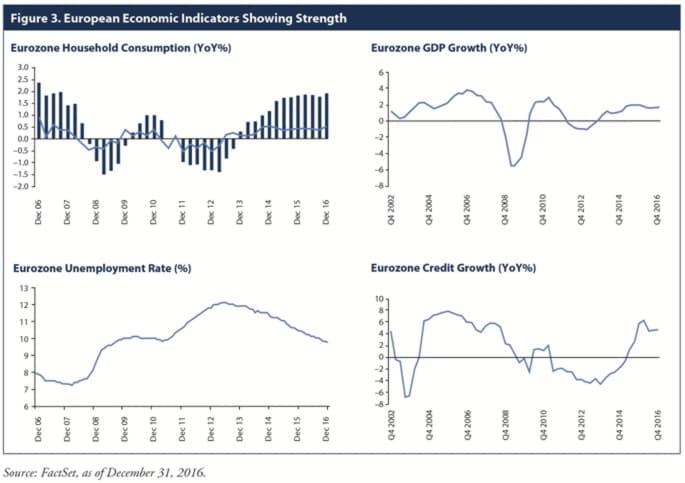

Politics aside, EU economic data has indicated that recovery is gaining momentum, supported by global reflation (see Figure 3). If indicators continue to improve, the ECB might consider tapering its quantitative easing.

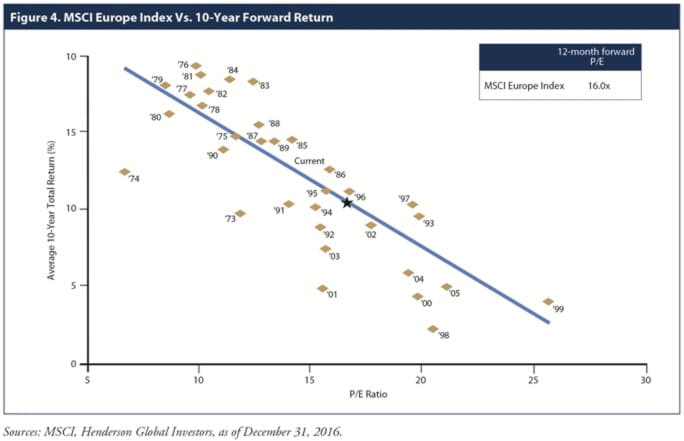

European equities, on the other hand, are trading below their long-term median valuations. Current price-to-earnings (P/E) ratios have historically signaled long-term gains. After six years of negative or mildly positive corporate earnings growth, earnings are expected to accelerate by the low teens in 2017, further supporting valuation expansion (see Figure 4).

What does thismean for investors?

There are a few possible outcomes for investors.If the political risks in Europe are successfully negotiated, the associated market stress could recede quickly, presenting multiple opportunities for capital market participants.If you’re a moderately conservative equity investor, funds focused on companies domiciled in the core Northern European countries would be a relatively low risk, given their low P/E ratio and the expectation of rising value once their economies stabilize. For deeper-value contrarian investors, selected equities of peripheral nations could present attractive opportunities, though this pathshould be tread carefully.

If, however, the populists were to prevail and negotiations go south, macro risks could skyrocket overnight, unraveling the strength in underlying economic data and earnings growth.

Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.

This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.

Gary Williams is President and Founder of Williams Asset Management located at 8850 Columbia 100 Parkway, Suite 204, Columbia, MD 21045. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. Gary can be reached at (410) 740-0220 or at Gary@WilliamsAsset.com.

Click here for a free download the Foreword (written by NFL Legend Ronnie Lott) and Chapter 1 of The Art of Retirement by Gary Williams. Authored by Anu Gaggar, CFA®, senior investment research analyst, at Commonwealth Financial Network®.© 2017 Commonwealth Financial Network®