What happened?

Leading healthcare REIT Welltower (NYSE:HCN) announced a partnership with Johns Hopkins Medicine with the goals of improving care for the aging population, as well as developing a modern and efficient healthcare infrastructure.

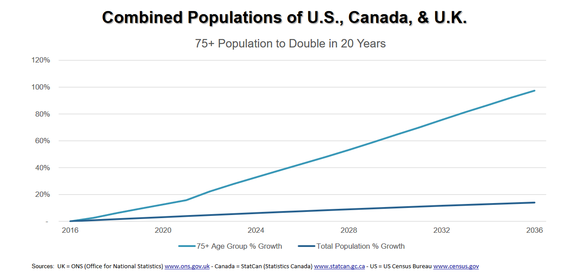

Since the older age groups are the fastest-growing segment of the population, it will be important throughout the next few decades to be able to adapt the healthcare system to the rising number of senior citizens, and to make sure their needs are met.

IMAGE SOURCE: GETTY IMAGES.

According to Mercedes Kerr, Welltower's Executive Vice President of Business Development and Relationship Management, "Care cannot always be delivered in the high cost hospital setting and for the transition to be successful, real estate needs to have a seat at the table."

IMAGE SOURCE: WELLTOWER.

The initial focus of the collaboration will be to explore joint initiatives such as:

- Measuring quality outcomes in assisted living and memory care.

- Developing educational programs, for patients and caregivers.

- Combining the resources of both companies to share best practices.

In addition, the partnership plans to assess opportunities to invest in modern and efficient healthcare facilities.

Does it matter?

"Welltower is ideally positioned to partner with major academic and regional health systems, a move which will allow us to capture important value for shareholders." Kerr said. "Through this collaboration, we aim to capture operational and investment opportunities for the benefit of Welltower's shareholders, as well as our partners and the consumers they serve."

Kerr also said that as Johns Hopkins expands its outpatient and ambulatory care systems, Welltower can offer its unique experience to help achieve this goal. And Welltower can leverage its existing vast network of senior housing operating partners -- which reads like a "who's who" of the senior housing industry -- to develop new state-of-the-art care solutions.

"In one of our Midwest markets, for example, we brought together one of our leading memory care operators with a large regional health system to help their patients with Alzheimer's and dementia through a referral system and training modules," Kerr said. "This approach benefited Welltower's two area seniors housing communities with a 200-basis point increase in occupancy."

The long-term impact of a just-announced partnership is anyone's guess at this point. However, the collaboration shows that although it's the largest healthcare REIT in the business, Welltower is still being proactive when it comes to finding future growth opportunities and staying ahead of its competition.

So, while this isn't necessarily game-changing news, it should certainly put a smile on the faces of Welltower's investors for the long-term opportunities it creates.

Trump's potential $1.6 trillion investment

We aren't politicos here at The Motley Fool. But we know a great investing opportunity when we see one.

Our analysts spotted what could be a $1.6 trillion opportunity lurking in Donald Trump's infrastructure plans. And given this team's superb track record (more than tripling the market over the past decade*), you don't want to miss what they found.

They've picked 11 stocks poised to profit from Trump's first 100 days as president. History has shown that getting in early on a good idea can often pay big bucks – so don't miss out on this moment.