Joel Kallett

Click here for Part I

A dynamic investment banking firm with a culture rooted in long-term growth and camaraderie

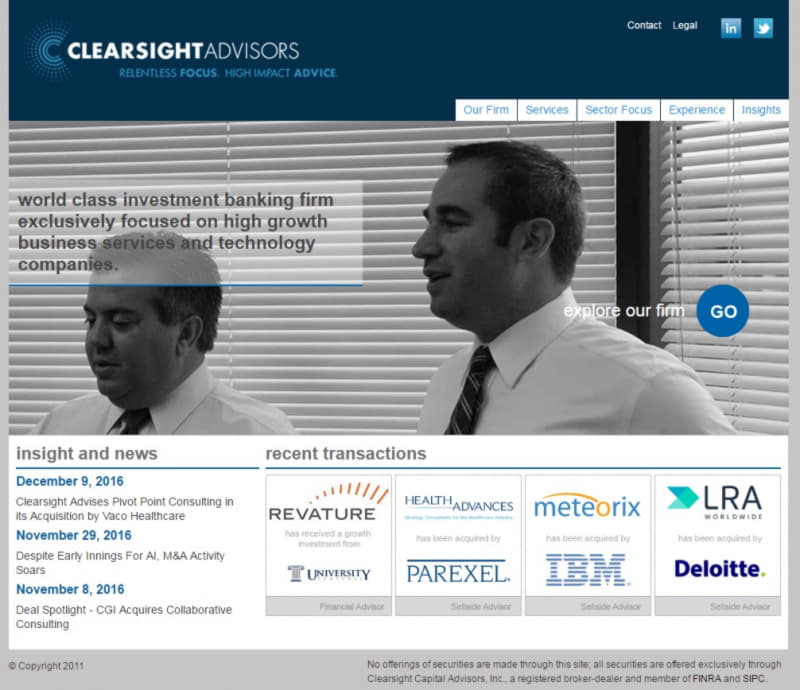

Joel Kallett is the CEO and Managing Director of Clearsight Advisors, an investment banking firm with offices in the DC metropolitan area and Dallas, Texas. Clearsight digs in deep to its work with its clients, emphasizing long-term strategic goals, tangible results, and insights that go above and beyond expectations. The firm has provided M&A and capital-raising advisory services to high-growth technology and software companies successfully acquired by organizations such as IBM, Accenture, and Ernst & Young. As of this writing, the latest company to benefit from Clearsight’s advisory services was Pivot Point Consulting, which was acquired by Vaco Healthcare in December 2016.

Joel Kallett spoke with citybizlist publisher Edwin Warfield for this interview.

EDWIN WARFIELD: You walked us through your career prior to Clearsight. Can you tell us more about the founding philosophy behind the firm?

JOEL KALLETT: I’d always been an entrepreneur at heart. Investment banking was a way to get a window into a lot of different businesses and business models—and challenges that they faced. Before Greg and I took our team to Houlihan to launch that effort, we thought long and hard about building out our own firm. This was around 2006. We just felt like it wasn’t the right time in the market—or for us personally—to launch that effort, but that was always in the back of our minds. We thought there was certainly a different and from our perspective better way to pursue the market opportunity. In doing so, and as 2011 approached, we saw that there was an opportunity to do two things differently.

The investment banking world will always be a transaction-oriented environment, but we felt like the pendulum had swung too far, and that the only thing that the larger investment banks wanted their senior bankers to do was fly in the day before a pitch, pitch the business, win the business, hand it off to a junior team, and run a sale process. We didn’t find that professionally or personally rewarding. We really thought less about what we cared about, but that the clients were going to rebel against that and want a real value-add, strategic financial advisor to help them think about a lot of the complex issues around building their business, restructuring their balance sheet, getting more growth capital, making buy-side acquisitions, and then ultimately monetizing their business through a sell-side transaction. We wanted to set up a business that enabled us to do that.

Secondly, what we saw happening in the areas in which we focused were that most of our competitors at that time—and even still today—are siloed in a services or software or data and information practice area. We saw that the more sophisticated buyers out there in the market—the Accentures, the Oracles, the Deloittes of the world—were starting to do what they hadn’t done historically, which is services used to buy services, software bought software—they started crossing those historic lines to put together solutions because their end clients wanted a full solution.

They just said: “Here’s my problem—I need you to help me solve it.” What we saw that was missing from the market was an investment bank that was really focused on understanding across that spectrum of universe—media and information businesses, high-end professional services, and software businesses—how to help them cobble together the right solutions. We wanted to take Clearsight with both that strategic financial advisor angle as well as that converged solution around technology services and data, and offer something different to the market. That was the impetus for the launch.

We went to a number of our former clients that we had helped monetize their business. We pitched our plan and our strategy. We raised some initial capital so that we could really bring our team en masse to pursue this opportunity that we saw in the marketplace.

We launched the business five years ago now. What was a little bit of marketing hype at the beginning has actually proven to be true, and that is where the vast majority of our business and where our message really seems to resonate with clients.

Connect with Joel on LinkedIn

Edwin Warfield, CEO of citybizlist, conducts the CEO Interviews.

If you're interested in reaching CEOs, please contact edwin.warfield@citybuzz.co

Connect on LinkedIn